Essential Checklist for Small Business Start-ups Success

Starting a new business in the UK is an exciting venture, one that requires meticulous planning and a solid foundation of knowledge to ensure success. The landscape of small business start-ups is dynamic and full of potential, yet it is also governed by a set of essential requirements that entrepreneurs must adhere to. From creating a well-structured business plan to understanding the legalities of running a business, each element plays a crucial role in the smooth operation and growth of a start-up.

Navigating the realm of small business ownership is no small feat. It demands a keen understanding of financial management to keep the business afloat, alongside crafting compelling marketing and branding strategies to carve out a unique marketplace identity. Prospective business owners must also equip themselves with the knowledge to address common queries and overcome the typical hurdles that a start-up may face.

Key Takeaways

- Understanding the basic framework for a business plan is pivotal.

- Compliance with legal and registration processes is mandatory.

- Effective financial and marketing strategies drive business growth.

Business Plan Basics

A solid business plan underpins the foundation of any successful small business start-up in the UK. It precisely communicates the company’s goals and the strategies for achieving them.

Executive Summary

The Executive Summary serves as a snapshot of the business plan, offering quick insight and encouraging further exploration. It must capture the essence of what the business will do, its USP (Unique Selling Proposition), and summarise the main points of what follows, including your business objectives and how you intend to meet them.

Market Analysis

Market Analysis is a comprehensive evaluation of the industry, target market, and competition. Enterprises must demonstrate an understanding of market trends, customer demographics, and pricing strategies. A precise analysis can identify market gaps and forecast potential growth, providing a competitive edge in the industry.

Financial Projections

Financial Projections are crucial for predicting the financial future of the business. A sound projection includes detailed forecasted income statements, balance sheets, and cash flow statements for the next three to five years. Businesses should also outline the break-even analysis and provide realistic scenarios that consider various levels of success.

Legal Requirements and Registrations

When embarking on new business venture in the UK, one must navigate a series of legal obligations and registrations that are essential for compliance and successful operation.

Business Structure Selection

Selecting the appropriate business structure is a crucial decision that affects taxation, liability, and administrative requirements. Sole traders have the simplest registration process, while limited companies require incorporation at Companies House, entailing more complex reporting and management duties. Partnerships offer a middle ground, sharing responsibility among partners. The choice of structure should align with the legal documents every start-up business needs for success.

HMRC Registration

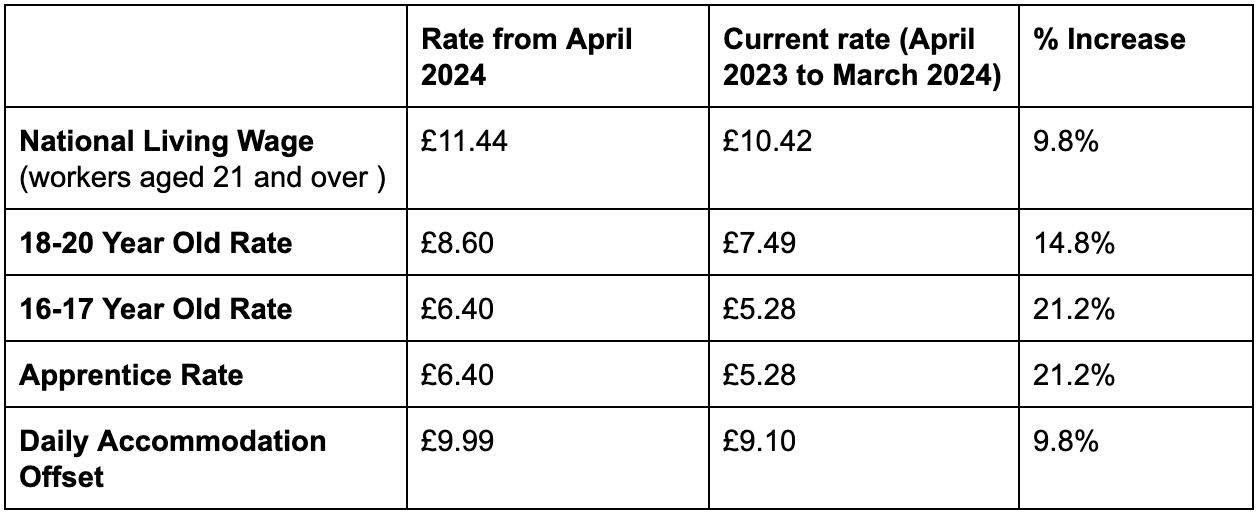

Businesses start-ups must register with HMRC to ensure they are paying the correct amount of taxes. This could include income tax, National Insurance Contributions (NICs), and if applicable, Value Added Tax (VAT). The VAT registration threshold can change, so it’s necessary to keep abreast of current limits. Sole traders and partnerships register by October 5th in their second year of trading, while limited companies register upon inception. For comprehensive guidance, refer to the rules for HMRC registration.

Data Protection Compliance

With the prevalence of digital information, businesses need to adhere to data protection laws to safeguard personal information. The UK General Data Protection Regulation (GDPR) and the Data Protection Act 2018 set the standards for data handling. Companies must ensure transparency in how they collect, use, and store personal data, as well as implement measures to prevent data breaches. Compliance is not optional, and penalties for violations can be significant, underscoring the importance of proper data laws compliance.

Financial Management

Effective financial management is crucial for small business start-ups in the UK. It sets a solid foundation for all financial activities, ensuring compliance with regulations and facilitating informed decision-making.

Opening a Business Bank Account

A business bank account is essential for keeping personal and business finances separate, simplifying bookkeeping and tax filing. It also enhances credibility when dealing with customers and suppliers. Startups must choose their bank wisely, considering factors such as fees, accessibility, and additional services offered.

Setting up Accounting Procedures

Accurate accounting is fundamental for tracking the financial health of a startup. Businesses should establish accounting procedures early on, which include recording transactions, reconciling bank statements, and preparing financial reports. Implementing software solutions can streamline this process, while guidance for small business accounting provides further direction on the specifics.

Insurance Considerations

Insurance is a key component of risk management for any startup. The right insurance policies can protect against unforeseen events that could jeopardize the financial stability of the business. Startups should assess their risks and secure insurance accordingly, which may include public liability, professional indemnity, and employers’ liability insurance, as legal requirements dictate.

Marketing and Branding Strategies

Effective marketing and branding strategies are crucial for the growth and recognition of small business startups in the UK. They ensure that a business stands out in a competitive landscape and connects with its target audience.

Developing a Brand Identity

A brand identity is the visual and conceptual representation of your company. This includes the creation of a mission statement and core values that resonate with customers. It’s vital to define your brand personality, colour schemes, logo, and typefaces that will be consistent across all marketing materials.

Online Presence and Digital Marketing

In today’s digital age, a robust online presence is imperative for small business startups. An effective website and social media strategy can greatly enhance visibility. Utilizing SMART goals can align digital marketing efforts with measurable business objectives, such as increasing web traffic or generating leads.

Networking and Local Engagement

Building a network and engaging locally can form strong relationships and open doors to new opportunities. Startups should actively participate in local events and collaborate with other local businesses. This can lead to valuable partnerships and increases the chances of word-of-mouth referrals which are beneficial for growth and sustainability.

Frequently Asked Questions

This section answers pressing questions a budding entrepreneur might have when considering launching a small venture in the UK.

What are the essential steps to setting up a small business in the UK?

Small business start-ups involves several key steps including writing a detailed business plan, working out finances, and choosing a business structure. One must also establish a business bank account and build a brand identity.

Which permits and licences are required to legally operate a new business in the UK?

The permits and licences vary depending on the type of business and its location. It’s vital to research and obtain the specific ones, such as food hygiene certificates for restaurants or a premises licence for retail establishments.

How can one start a small business from home in the UK, and what are the specific considerations?

Starting a business from home requires compliance with residential zoning laws, securing any necessary planning permissions, and consideration of insurance needs. Entrepreneurs should also maintain professional boundaries within their living space.

What are some viable business ideas that can be started with a £1000 budget in the UK?

A modest budget of £1000 can seed businesses such as freelance writing, home tutoring, or a small-scale e-commerce operation focusing on niche products.

In the current UK market, what types of businesses are in high demand?

Businesses in the tech sector, health and wellness, and eco-friendly products are presently experiencing high demand in the UK market.

What is the best small business to start in the UK considering market trends and potential profitability?

The best business to start typically aligns with current market trends such as sustainable goods, online education platforms, or personalised health services, as these sectors offer potential profitability.

Ready to begin your business journey we can help. Contact us today.