Table of Contents

A Step-by-Step Guide to changing the name of a UK limited company.

Changing a limited company name in the UK is a common step for businesses looking to rebrand or move in a new direction. To change a limited company name, you must file the name change with Companies House and pay a small fee. This is usually done online, and after approval, Companies House will issue a new certificate of incorporation showing the updated company name.

Business owners should also remember that after changing the company name officially, they will need to update all business records, contracts, and inform customers and suppliers. This makes sure that daily operations run smoothly and the new name is recognised everywhere it needs to be.

Key Takeaways

- A company name change is done online through Companies House.

- Update all business records and inform stakeholders after the name change.

- Approval comes with a new certificate showing the new company name.

How to Change Your Limited Company Name

Changing a limited company name in the UK is a formal process. Certain legal steps and official paperwork must be completed through Companies House.

Legal Requirements for Company Name Changes

A company can only change its name through a formal decision called a special resolution. This means that the majority of shareholders must agree to the new name before starting the process.

The new name must follow strict rules. It cannot be offensive, too similar to existing company names, or use restricted words unless permission is given. The name must end with “Limited” or “Ltd” for private limited companies.

If the company uses sensitive words or expressions, extra approval from regulatory bodies might be needed. Full guidance on naming rules is found on the official government website. Making sure the new name fits the legal requirements will help avoid delays.

Step-by-Step Process to Change the Name

1. Hold a Meeting:

Directors must propose the new company name at a meeting. Shareholders then vote on the change through a special resolution.

2. Record the Decision:

Once the resolution passes, keep a written record for company files. Most companies need a 75% majority to agree.

3. Check Name Availability:

Search the Companies House register to make sure the new name is not already taken and meets registration rules.

4. Prepare Documents:

Fill out the required form (usually Form NM01) and the signed copy of the special resolution.

5. Pay the Fee:

Official detail on costs and submission is explained on Companies House company name change guidance.

Submitting Form NM01 to Companies House

Form NM01 is the official application used to change a limited company name in the UK. It must be filled out and sent to Companies House after the special resolution is approved.

Include all details asked for on the form, such as the company number, current name, and the new proposed name. Attach a copy of the special resolution agreeing to the name change.

Form NM01 can be submitted online through the Companies House service or by post. Online submission is usually faster. Payment must be made at the same time as submission. Processing times vary, but the change is only official when Companies House updates their records and issues a new certificate of incorporation with the new name. For detailed instructions, see Companies House NM01 change process.

Actions to Take After Changing Your Company Name

Once a company name has been changed, there are several important steps to make sure all records are current, legal, and consistent. Failing to update these crucial areas can cause communication problems or legal issues.

Updating HMRC and Other Authorities

Companies must tell HM Revenue & Customs (HMRC) about any change to their name. This keeps tax and payroll records under the right details. Informing HMRC can be done by contacting the office directly or using the online service provided by Companies House.

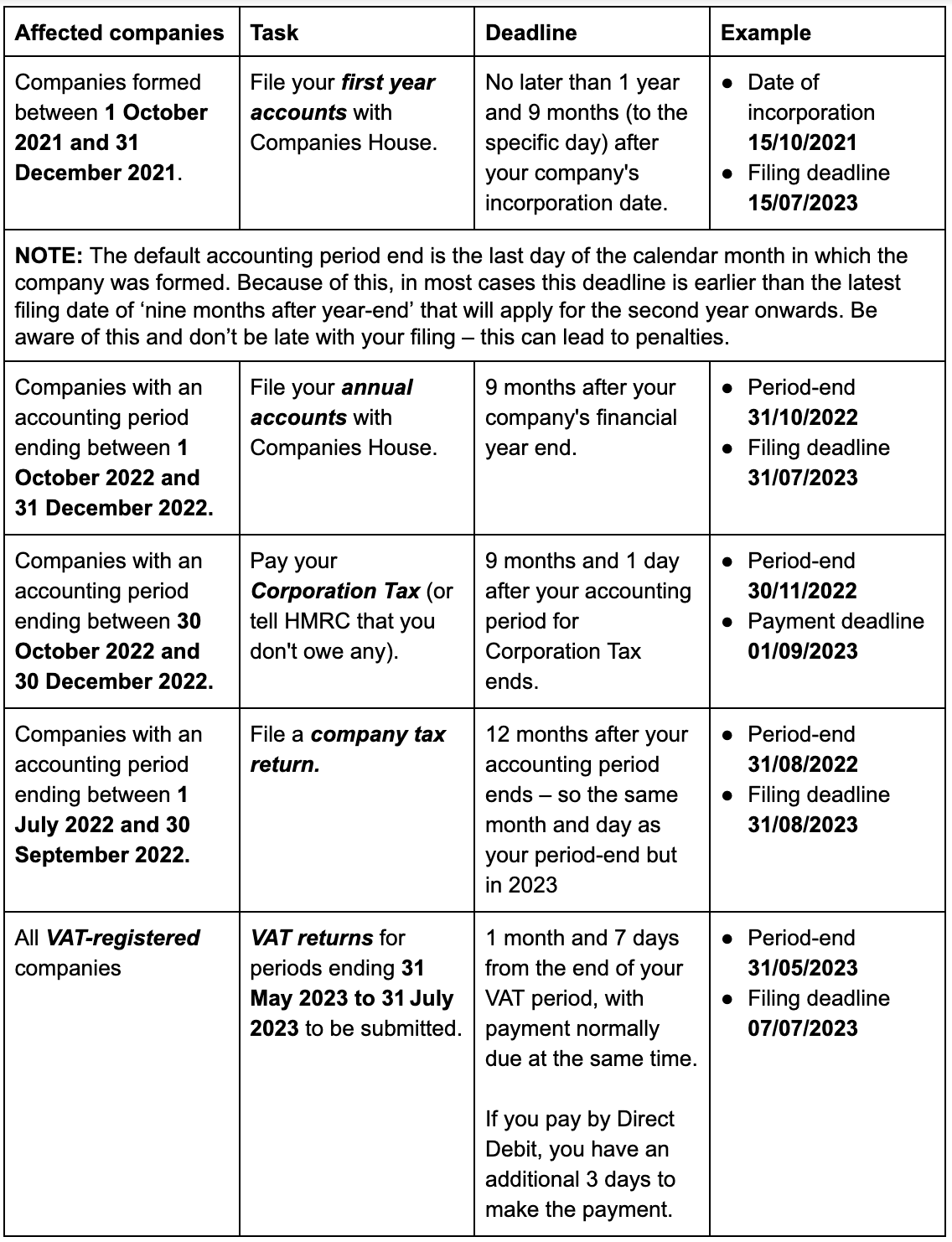

It is also essential to share the new company name with other government bodies. This may include local councils, the Information Commissioner’s Office (ICO), or any licensing authorities if they hold licences. For VAT-registered businesses, the new name must be added to the VAT account. If the company pays business rates, the council will also need the new details.

Keep a record of all contact with these agencies. This helps if questions come up later and ensures nothing is left out.

Amending Legal Documents and Contracts

All legal documents must show the new company name. This includes existing contracts, leases, supplier agreements, and client arrangements. Companies need to review all contracts and update them with their new name as soon as possible.

Notify banks and insurance providers so account names, direct debits, and policies match the company’s new details. Update any intellectual property registrations, such as trademarks or patents, to avoid possible disputes. Some organisations may require a copy of the name change certificate for their records.

A checklist can help, for example:

- Bank accounts and loans

- Insurance policies

- Employment contracts

- Supplier and client agreements

- Software licences

Updating these documents avoids miscommunication and reduces risks in future disputes.

Changing Business Stationery and Branding

The company’s name must be changed on all printed materials and digital assets. This includes letterheads, invoices, order forms, business cards, websites, and email addresses.

Employees should be informed about the change so all outgoing communication shows the correct name. Social media profiles, signage, and advertising should also be updated to reflect the new company identity.

To avoid problems with deliveries or client payments, update the new name on all paperwork and payment details. For a full list, companies can review their daily business tools:

- Email signatures

- Signage (internal and external)

- Company website

- Company vehicles

- Packaging

Attention to detail is key to keeping the business reputation and making the transition smooth. For more on the steps to change a company name, see how to update your company’s name at Companies House on the government website.

Frequently Asked Questions

To change a limited company name in the UK, there are specific forms, online steps, and legal fees. Certain effects and timelines are involved, and a checklist can help make sure everything is done correctly.

If you would like expert advice on changing your company anme, get in touch, we can complete this for you.

What documents are necessary for altering a limited company's name with Companies House?

A special resolution from shareholders is required. The company must complete form NM01 if filing by paper, or use the Companies House online service for electronic submissions.

Supporting documents may include copies of the resolution and any required supporting paperwork. Details can be found on the official UK government website.

What steps must one follow to update a limited company's name through WebFiling?

Log in to the Companies House WebFiling portal. Select the option to change the company name and complete the named sections.

Submit the required resolution and pay the applicable fee. Online filing is often quicker and costs less than paper forms.

What are the potential consequences of modifying a limited company's name in the UK?

A name change will affect all official company paperwork, contracts, and bank accounts. Customers, suppliers, and HMRC must be notified.

The company’s records with Companies House and other organisations must be updated to reflect the new name.

What is the standard duration to complete a limited company name change process?

Changing a company name online with Companies House usually takes about 24 hours. Paper applications can take longer, often several days.

A same-day service is available for an extra fee if speed is important.

What charges are applicable when renaming a limited company?

Costs may differ if help is used from formation agents or legal advisors. For up-to-date information see the Companies House guidance.

What checklist should be followed when considering a name change for a limited company?

Make sure the new name is not already taken or restricted. Hold a board meeting to pass the new name by resolution.

File the name change with Companies House, update your statutory records, notify HMRC and your bank, and inform customers and suppliers. Check the step-by-step process for any additional steps.